Many people start investing by choosing products – a mutual fund, a stock, a fixed deposit, or an insurance plan. While these tools are important, they work best only when they are part of a larger investment strategy.

That is where an investment blueprint matters.

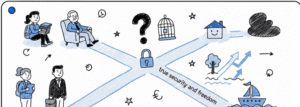

Strategy Comes Before Products

A sound investment approach begins with strategic thinking, not products.

Strategy helps answer the most important questions first:

- How much should you invest?

- Where should you invest?

- For how long should you stay invested?

- How do you balance growth with stability and risk?

Without clarity on these, even good products can fall short. Products are simply tools. Your investment strategy gives direction to how those tools are used and why they are chosen.

Why a Blueprint Matters

A portfolio shows what you own.

An investment blueprint explains why you own it and how it fits into your life goals.

A structured investment strategy connects your money to real objectives such as education, retirement, healthcare security, or long-term wealth creation. It also helps adjust decisions as income, responsibilities, or priorities change over time.

The Importance of Guidance

Financial decisions are personal. There is no single solution that works for everyone.

Good guidance helps turn financial goals into practical action by providing:

- Clarity on what is realistic and achievable

- Alignment between goals, time horizon, and investments

- Transparency about risks, expectations, and trade-offs

- Periodic review to stay relevant as life evolves

Guidance does not remove risk, but it helps you understand and manage it better.

A Clear Strategy Makes Every Investment Count

Building wealth is not about chasing the latest product or trend. It is about following a clear investment strategy, using the right tools at the right time, and reviewing decisions as circumstances change.

When strategy leads and products follow, your investments are more likely to stay aligned with your goals – today and in the years ahead.