Many people start investing by choosing products – a mutual->

Stop Guessing.

Start Engineering

Your Financial Future.

From your first SIP to large and complex portfolios - we provide the personalized investment roadmap you need.

Building Wealth Across Generations

20+ Years

of Experience

Building Wealth Across Generations

20+ Years

of Experience

Empaneled With

How we can help you

Investment solutions tailored to your life stage, goals, and risk profile.

For Those Already Retired

Retirement Income Solutions

Turn your retirement corpus into reliable, tax-efficient monthly income. We help you balance preservation with growth, ensuring your savings support you throughout your golden years.

The F.I.R.E. Roadmap

Early Retirement Investing

A personalized investment approach to early retirement. Aggressive growth strategies for those who want to quit the grind early.

The 'Next Best' Solution

The Right-Fit Strategy

Can’t retire early but wish for financial peace and freedom? Different financial journeys need different investment paths. We focus on what’s achievable for you – helping you build security, stability, and financial growth step by step.

FOR THE DIY investor

Portfolio Correction

We analyze your existing app-based portfolio, fix the mistakes, and align it with professional market strategies.

For Beginners

The Smart Start

You don’t need millions to start. We help students, homemakers and small savers begin their journey with as little as ₹100.

Systematic investing for short, medium, & long-term goals

Future-Ready Investing for Life’s Big Milestones

From children’s education and weddings to home purchases and traditional retirement. We help you invest systematically so every milestone is funded on time – without stress or compromises.

Gift City, AIFs, Pre-IPOs & More

Large-Capital Investment & NRI Solutions

Investment opportunities for larger portfolios and NRIs, including Gift City structures, Alternative Investment Funds (AIFs), Pre-IPOs, and startup & angel investments.

Financial Instruments We Help You Access

A Complete Financial Product Ecosystem. Access a range of financial products – investments, insurance, retirement solutions, and liquidity options – in one place.

Investments

Mutual Funds

Equity

ETFs

Fixed Deposits (FD)

Protection

Life Insurance

Health Insurance (Mediclaim)

General Insurance

Retirement & Long-Term Savings

NPS

Liquidity Solutions

Loan Against Mutual Funds

Specialized Opportunities

GIFT City investments

AIFs (Alternative Investment Funds)

PMS

Angel Investments

Pre-IPO opportunities

Not sure which path fits your situation? Let's discuss it.

Book a Bridge Call to evaluate your current position and explore the next steps for your investment journey.

- The ‘Bridge Call’ is a 20-minute diagnostic conversation to understand your current situation and goals

- See if our approach fits your needs

- No obligation conversation offered at no cost to ensure mutual fit before engagement.

- Happens via call at a time that works for you

How it Works

The 5-Step Process

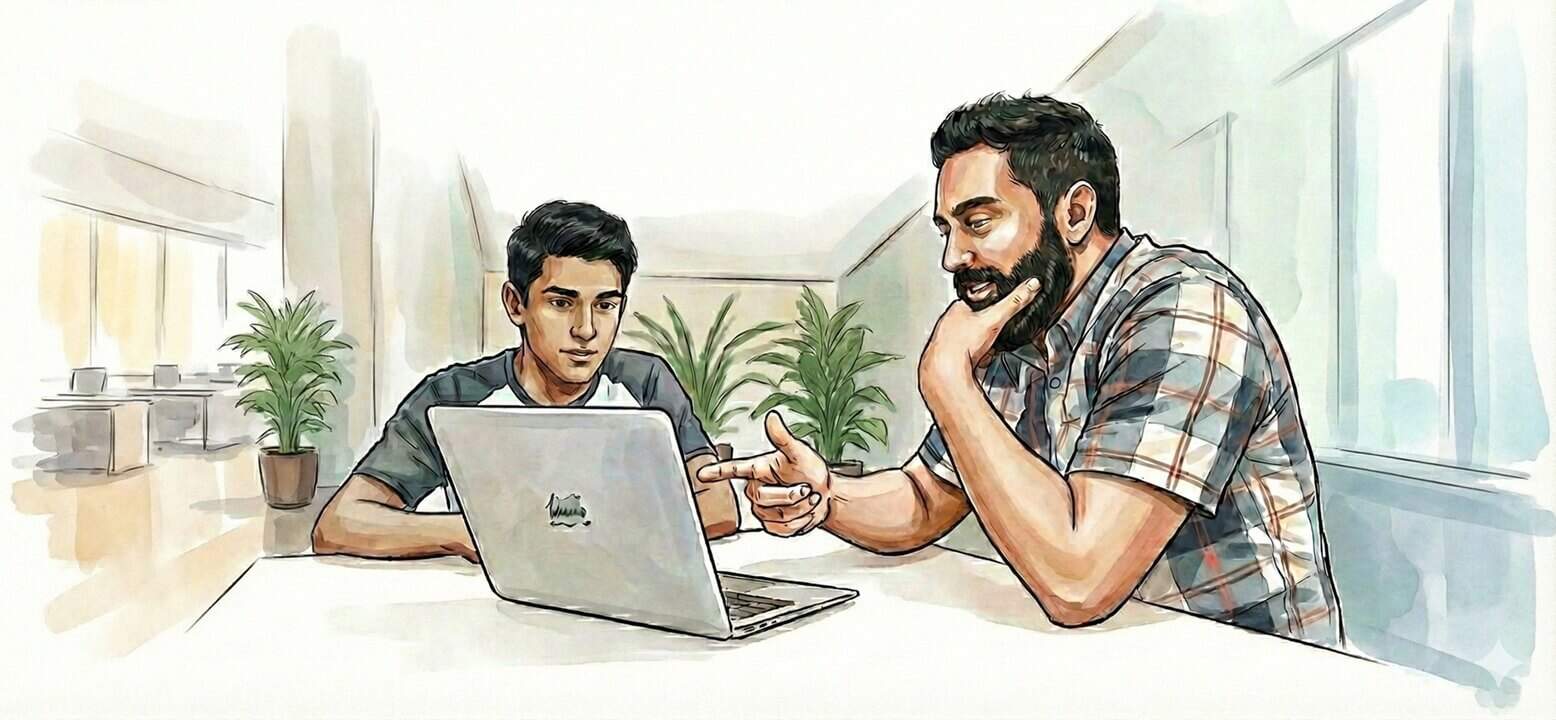

Visit us at our office for a chat over tea, or request a Bridge Call to understand your goals and see how we can help. A 20-min exploratory conversation is offered as a courtesy, in person or by call.

1

Understand Goals

2

Risk Profiling

3

Portfolio Construction

4

Periodic Review

5

Long-term Support

SetuWealth Advantage

Strategic Investing. Built Around You.

Personalized for Your Situation

Most investment platforms give you tools. We give you a strategy. Every recommendation is tailored to your actual income, goals, and risk capacity - No generic templates or cookie-cutter portfolios. You get a roadmap designed specifically for where you are and where you want to go.

Track Your Investments Anytime

24/7 digital access to your portfolio through our client dashboard. Monitor your investments and progress toward goals on your schedule.

Clear Communication, Always

We explain recommendations in straightforward language and ensure you understand the reasoning behind every decision.

Support That Lasts Beyond the Transaction

Your financial life doesn't stop after you make an investment - and neither does our relationship. We provide ongoing reviews, adjustments when your circumstances change, and guidance whenever questions come up. You're not left to figure things out alone after your portfolio is set up.

Personalized for Your Situation

Most investment platforms give you tools. We give you a strategy. Every recommendation is tailored to your actual income, goals, and risk capacity - No generic templates or cookie-cutter portfolios. You get a roadmap designed specifically for where you are and where you want to go.

Track Your Investments Anytime

24/7 digital access to your portfolio through our client dashboard. Monitor your investments and progress toward goals on your schedule.

Clear Communication, Always

We explain recommendations in straightforward language and ensure you understand the reasoning behind every decision.

Support That Lasts Beyond the Transaction

Your financial life doesn't stop after you make an investment - and neither does our relationship. We provide ongoing reviews, adjustments when your circumstances change, and guidance whenever questions come up. You're not left to figure things out alone after your portfolio is set up.

Let's Build Your Bridge.

You don’t need to have everything figured out before we talk. That’s what the Bridge Call is for – to understand your needs and discuss how we can help. Take the first step towards financial clarity with a no-obligation conversation.

Let's Build Your Bridge.

You don’t need to have everything figured out before we talk. That’s what the Bridge Call is for. Take the first step with a no-obligation conversation.

Frequently Asked Questions

The 5-Step Process

What is the 20min Bridge Call? Are there any charges for this conversation?

The Bridge Call is a no obligation 20-minute conversation designed to understand your current financial situation and goals. Think of it as a diagnostic session – we listen to where you are, discuss where you want to go, and determine if our investment approach aligns with your needs.

Are there any charges for this conversation?

No. This diagnostic conversation (not a consultation) is offered at no cost to assess mutual fit. There’s no obligation to commit to further services.

When can I expect to receive my call?

After you submit your request, we’ll reach out via your preferred mode of communication – call, WhatsApp, or email – within 48 business hours to schedule a time that works for both of us. As our founder personally handles many client relationships and is often in on-site meetings, we coordinate schedules thoughtfully to ensure each conversation receives full attention.

What is included in the 20min Bridge Call?

We’ll ask about your current financial situation, your short-term and long-term goals, and any specific concerns or priorities you’re facing. This might include questions about your income, existing investments, family responsibilities, and what financial outcomes matter most to you. Based on this conversation, we’ll outline whether our services can help you, what the next steps might look like, and answer any questions you have about our approach. You’ll leave the call with clarity about your options – whether you work with us or not.

What is not included in the Bridge Call?

The Bridge Call is a diagnostic conversation to understand your financial situation, clarify your goals, and you can determine whether SetuWealth’s services align with your needs or not. During this call, we discuss your current circumstances and priorities in general terms. The Bridge Call does not include specific investment recommendations, detailed portfolio analysis, or implementation guidance. These services are provided as part of our formal client engagement after the Bridge Call, if you choose to proceed.

What if I'm just starting out with small amounts? Is this call still relevant for me?

Yes, completely. Whether you’re early in your career or managing significant assets, the Bridge Call serves the same purpose – understanding your unique situation and creating a roadmap tailored to your capacity and goals. We’ve built our practice on the principle that quality investment guidance should be accessible to everyone, not just the already wealthy. Your starting point doesn’t determine whether we can help you; your commitment to building a stronger financial future does.

Where can we meet you in person?

You are welcome to visit us at our office. We encourage clients to schedule an appointment in advance so we can give you dedicated time and attention.

Our office address and contact details are available on the Contact page.

SetuWealth's

Money Explained

Don’t Just Save. Invest with Purpose.

Saving and Investing Serve Different Purposes Saving is important for->